TRANSACTIONS

Récentes Transactions

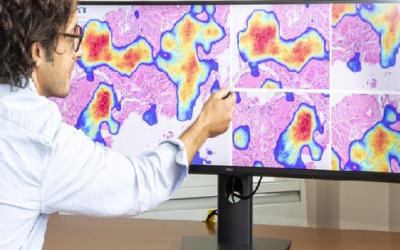

2025 : Azalea Vision secures a 9m€ financing in a first series A closing

2024 : AdScientiam secures an undisclosed financing to fuel its growth

2024: Primaa secures pre-series A financing

2024: InHeart secures 10m€ series A financing

2023: Novadip secures 18M€ venture loan financing with EIB

2023: Avatar Medical secures 5M€ seed financing

2022 : TechnoConcept secures 4.4M€ financing and secondary buy-out

2022 : Harmony Biosciences acquires Bioprojet’s Wakix XR US licensing rights

2021 : Novadip 21M€ series B1 financing

2021 : Robocath secures 15M€ financing with EIB

2020 : Robocath 40M€ series C financing

2020 : European Licensing-out Advisory for Catabasis Pharmaceuticals

2019 : Beaver Visitec acquires Arcadophta

Bionest Partners Finance a réalisé un grand nombre de projets de conseil financier pour des startups Healthtech et des sociétés pharmaceutiques spécialisées (fairness opinion, business plan, deal structuration).